近年来,投行求职竞争愈发激烈,尤其是对国际学生而言。最新数据显示,顶尖投行的毕业生录取率正在迅速下滑,甚至可能很快跌破0.1%。

高盛、摩根大通等机构的申请人数连年暴增,而岗位数量不增反减。作为在美留学生,如何在这场近乎“残酷”的竞争中脱颖而出?

投行录取率正在断崖式下跌

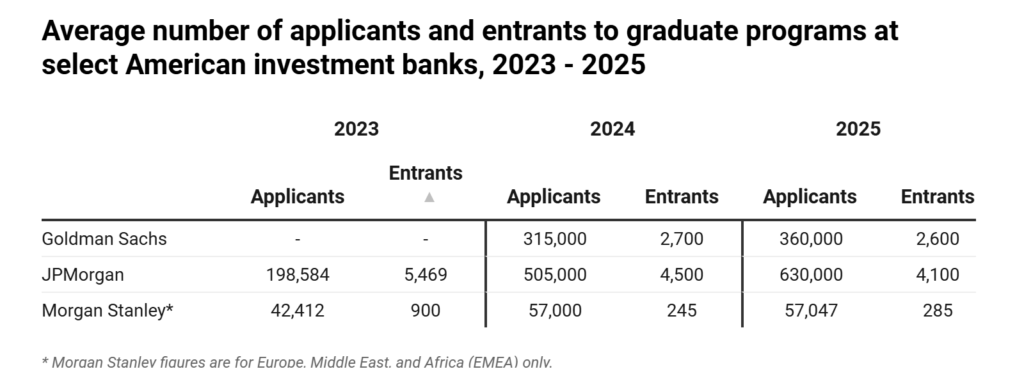

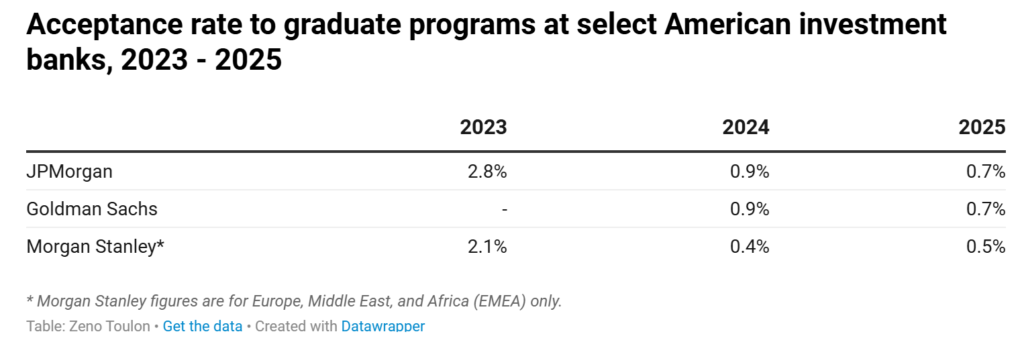

投行向《金融新闻》提供的新数据证实了这一趋势,今年,高盛有 360,000 名申请者,拥有 2,600 个研究生和实习职位。 去年高盛在 2,700 个名额上拥有 315,000 个。2022 年,高盛有 236,000 名申请者,获得 3,000 个名额。

不仅仅是高盛,2025 年,摩根大通有 630,000 名申请者申请了 4,100 个实习生职位,录取率为 0.7%,低于两年前的 2.8%。

2024 年至 2025 年间,摩根大通全球学生项目的申请人数增加了 25%。在此期间,可用项目数量下降了 9%。按照这个逻辑,到 2030 年,将有 200 万人申请该公司的 2,600 个实习机会,录取率将仅为 0.13%。

如果目前的趋势继续下去,那么高盛(Goldman Sachs)到 2028 年将有 550,000 名申请者申请 2,250 个职位空缺,其录取率将降至 0.2%。

这些数字背后,是全球顶尖学生之间的激烈比拼,作为留学生,你不仅要和本地学生竞争,还要面对来自世界各地优秀申请者的挑战。

AI面试成主流,HireVue成重要关卡

如今,HireVue视频面试已成为多数投行的首轮筛选工具。

无人提问,AI评分:系统自动出题,你在限定时间内录制回答。

行为问题占主导:60%-70%的题目属于行为类(Behavioral Questions),考察沟通、团队合作、问题解决等软实力。

技术问题悄然增多:尤其在精品投行(如Evercore)和买方公司(如Blackstone、BlackRock),技术类题目比例上升。

2025各投行HireVue真题曝光

我们整理了今年来自高盛、摩根大通、摩根士丹利、花旗、UBS等机构的真实面试题,供你参考:

🏦 摩根大通:

- Why JPMorgan?Why this role?

- What can you bring to this role?

- Pitch me something – a stock, product – anything.

- Tell me about a time you had to explain complex information to someone.

- What are you following in the market?

- How many iPhones do you think are sold in a year?

🏦 高盛:

- Why Goldman Sachs, and not a boutique?

- Walk me through a time you solved a problem.

- Tell me about a time you lead a team through a hard moment.

- Talk me through a work conflict. How did you solve it?

- How do you organize your sock drawer?

🏦 摩根士丹利:

- Which field would you go to if not finance or banking?

- What is something you consider important for teamwork?

- Briefly analyze one company you have studied before.

- Where do you see the stock market going within the year?

- If a stranger wants to take a loan from you, what would you consider?

🏦 花旗:

- Pitch me a stock.

- Give me an example of business news that you’ve read recently that could impact Citi.

- What challenges have you faced while working on a project?

- Tell me about a class you took, and how it may have helped you for this role.

- What are you following in the markets?